Imagine that you want to create small area demographic estimates, and you recognize that the annual data produced by the census bureau has two main deficiencies – temporal instability and timeliness. Naturally, you would want to find other data sources which would help to overcome these problems. The postal service seemingly provides such a data source – after all, the post office needs to be able to deliver mail to all households, including those that just moved into a new housing unit. Tracking the postal delivery system via the ZIP+4 system would seem to be an ideal way to inject more timely information into the estimation process since one could assume that when the post office adds new ZIP+4 points that it indicates growth. But should you use this as your only timely source of information? Absolutely not.

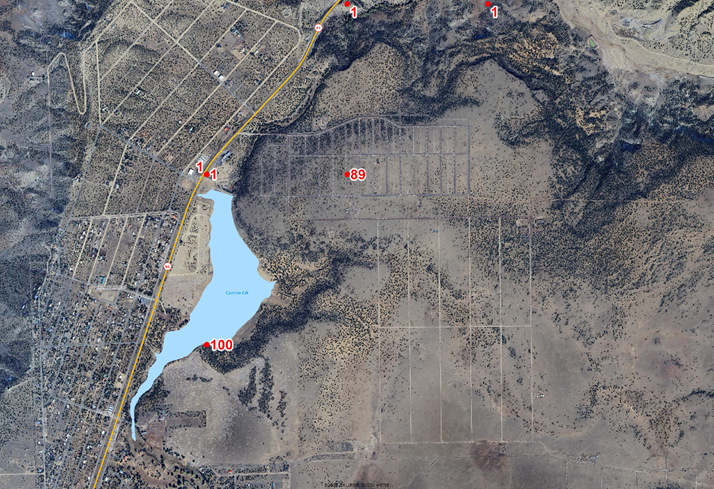

First, the creation of new postal codes indicates planned future growth, not current actual growth. Once a local government approves a development plan, the post office will create delivery points using the new street names and addresses. This often occurs long before the street and utility infrastructure is even started. One of the hottest areas in recent years has been in the north Dallas area, where the town of Princeton has more than doubled in population since the 2020 census. In the map below, note that we have 100 new ZIP+4 codes created in 2025, but this is located not where the current growth is, but where one can reasonably expect growth to occur within the next few years. To the west and south are the current developments, for which ZIP+4’s has already been established.

There is no question growth is occurring in the town, but to allocate households to this undeveloped tract would overstate the local population while understating the population in neighboring census blocks. In our view, new postal delivery points are more suitable for use in five year projections than current year estimates.

A second example comes from Santa Clarita, California, where the Stevenson Ranch property has been under development for quite some years. The area shown below is currently under development, with some areas of active construction and some areas which have been graded and are ready for construction. Note that there are no new ZIP+4 areas within this major development, except for two new areas at the south end of the development. Given the patterns, these new areas will be developed in the future, but likely only after the remaining area has been completed. Clearly, the ZIP+4 areas for the area currently under construction were created in the past. Development is current, but the ZIP+4 changes are now historical. Any estimates of population which rely on the creation of new ZIP+4 areas will be highly distorted.

A second issue arises because ZIP+4 geographies are highly inconsistent in terms of the number of households (mailboxes) that they serve. In many newer communities, mail delivery is to a cluster of mailboxes rather than to individual dwellings. If all new ZIP+4 areas are equivalent it is a serious error, albeit one that is likely spatially bound by current estimates of the city or county population total.

Third, planned development does not equal actual development. In northeastern Arizona, we find that over 500 delivery points were added in the vicinity of Concho, a census designated place with a whopping 51 dwellings, one third of which are vacant. The two areas with new ZIP+4’s near the existing settlement, one complete with roads, shows zero signs of development.

This is not to suggest that the postal layer is not useful in demographic estimation. On the contrary, we have been using these files for decades, but we don’t rely upon them for indicating where growth is now or has recently occurred. The creation of new ZIP+4’s means that something is likely about to occur. What do we do instead? We consider a wide range of indicators including:

- Are there changes in the individual parcels that indicate development? These include changes to the number and geometry of individual parcels as well as changes in ownership – specifically, from individuals to corporations.

- Show me the building permits! We track every building permit in almost every incorporated city nationwide, classifying them as new construction, renovations, and ADU construction. A permit is an indicator of construction now, not some time in the future.

- Has the street network changed? We track every road segment in the country from multiple sources looking for new and extended road segments.

- Do we need to consider changing satellite imagery? In areas where the source data gives conflicting signals, the analysis of imagery over time can provide confirmation on the ground.

What should be clear is that small area demographic estimates require the use of multiple, and costly, source databases that go well beyond the basics. At AGS, our data team, with decades of experience, won’t settle for anything less. Why would you?