After WWII, New York replaced London as the financial capital of the world. For several decades, if you wanted to be a player in the world of finance, you had to play in lower Manhattan.

Even prior to the latest mayoral election, there was talk about the waning primacy of New York in the financial industry (Texas becoming popular destination for Wall Street firms | Fox Business). While toning down remarks like seizing the means of production, the new mayor ran on a platform of taxing the affluent (people and companies) to provide free services like public transit and childcare. Understandably, this has made the financial sector just a little nervous and are perhaps considering renting a fleet of U-Haul trucks and heading off to more tax-friendly locales.

The concentration of the financial sector of the post-WWII era was a technological requirement – a world run on paper ledgers required the big banks to be close to the stock market. As computer technology, and especially communications, developed over the decades, it became possible to relocate many administrative functions to less expensive cities.

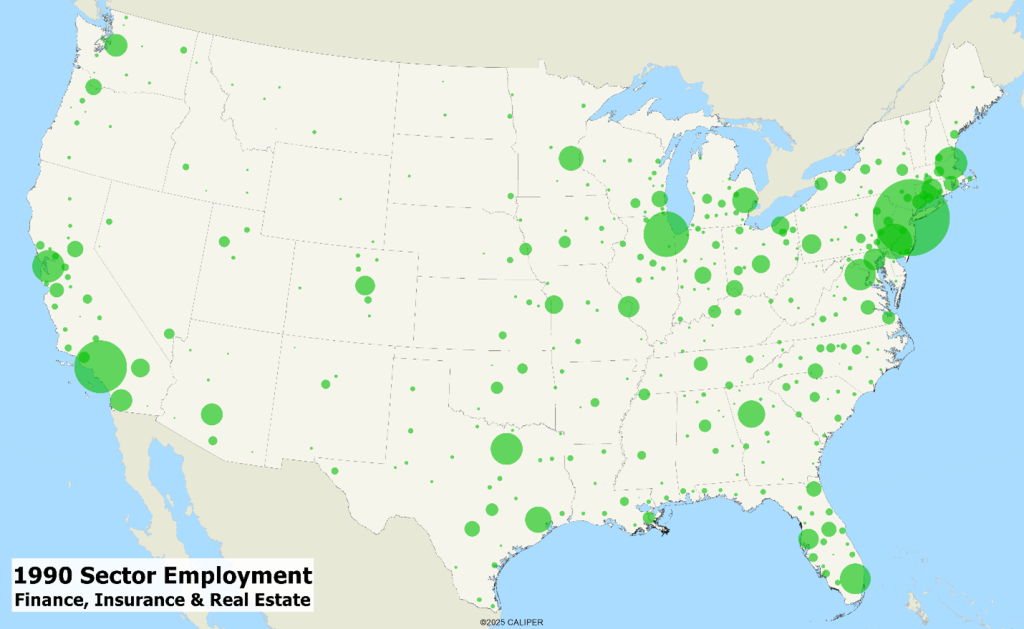

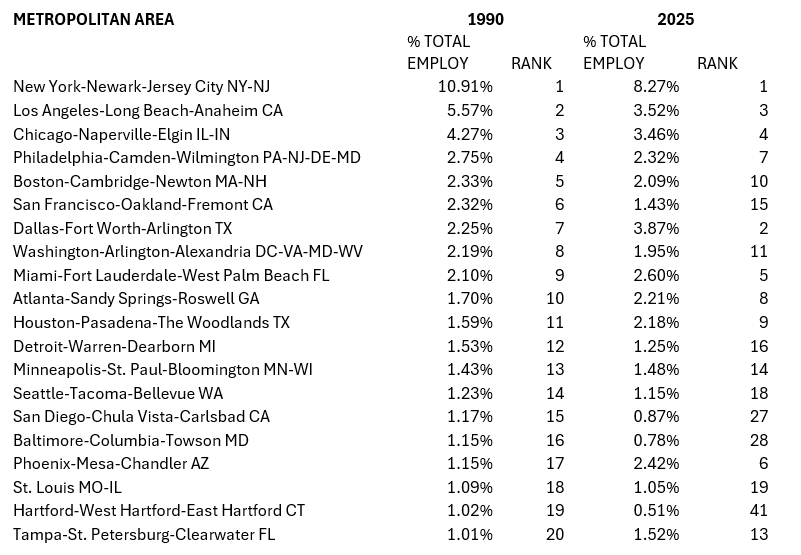

Since we don’t have data going back to the 1950’s, we took a look at the change in concentration of the financial sector from 1990 to 2025. The 1990 industry data covered a broader sector than we would like — finance, insurance, and real estate – but it does illustrate the decreasing importance of New York:

While New York remains the largest financial center, it is clear that major shifts have been occurring. The top 20 metro areas in 1990 are shown below, with their current rank showing some dramatic shifts. The biggest losers since 1990 have been Philadelphia, San Francisco, and Hartford. The largest gainers? Dallas-Fort Worth, Phoenix, Miami, and Charlotte. The rise of Charlotte as a banking center has largely been at the expense of San Francisco, as Bank of America has increasingly pushed administrative functions east.

So, what does the future hold? Technology has allowed banks to decentralize operations to the emerging (and less expensive) financial centers of Dallas-Fort Worth, Phoenix, and Charlotte. Some operations, especially the high frequency algo-traders, are tied to Wall Street since even a millisecond lag in placing orders from a distant location is a millisecond too much.

If Mayor Mamdani manages to enact even a fraction of his platform, we would expect the financial sector to accelerate its decentralization. While New York won’t relinquish its primacy anytime soon, we may see some major Manhattan banks all but flee the city since they already have significant regional offices elsewhere. Elections, even local ones, can sometimes have major consequences.