This blog post first appeared on the Kalibrate website.

As organized retail crime continues to impact stores, customers, and employees at alarming rates, data-driven site selection has become more critical than ever. With California’s governor recently signing into law significant legislation to crack down on property and retail crime, and the National Retail Federation pushing for the passage of the Combating Organized Retail Crime Act (CORCA), retailers are seeking ways to mitigate risks associated with new and existing store locations.

The rising price of retail crime

Retailers have reported that organized retail crime could lead to higher prices for shoppers and potential store closures. More alarmingly, many retailers have noted an escalation in violence associated with theft. According to the NRF, shrink represents $112.1 billion in losses annually.

Leveraging data for risk assessment

So, how can retailers understand and mitigate the risk of crime when evaluating new sites or assessing existing stores? The answer lies in comprehensive, data-driven analysis.

Understanding risk through CrimeRisk data

Datasets like AGS’ CrimeRisk can provide invaluable insights for decision-makers. Gary Menger, AGS Founder and President, states, “AGS offers dozens of datasets, and CrimeRisk is by far our most requested. Where crime was once out of sight, out of mind, that has changed dramatically over the last few years.”

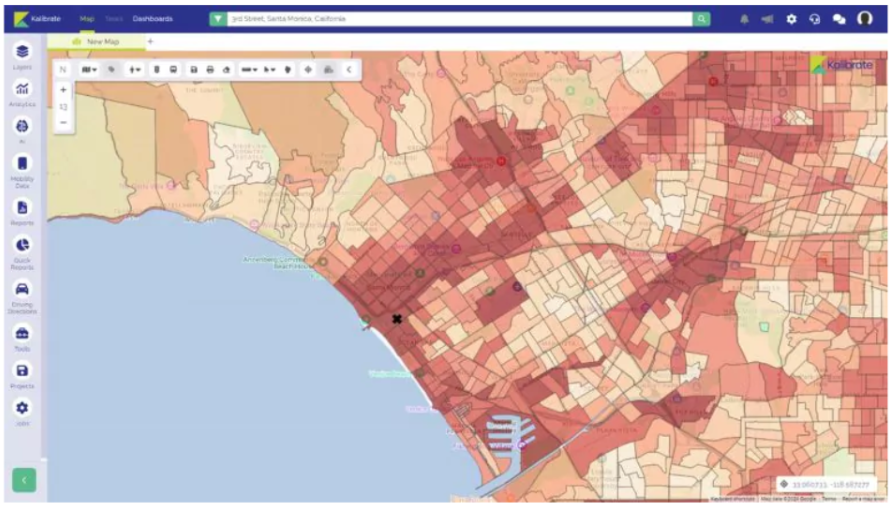

CrimeRisk is a geographically detailed and comprehensive crime assessment database that offers a highly accurate view of the relative risk of specific crime types for any geographic area, including Census blocks. Available through the Kalibrate Location Intelligence (KLI) platform, it allows retailers to view crime risk at various geographic levels.

Assessing long-term costs

Insurance companies already utilize AGS CrimeRisk data in their models. Retailers can leverage this same dataset to understand and project long-term costs related to property damage, break-ins, car theft, and shrinkage.

Dave Huntoon, Vice President at Kalibrate, explains, “One of the best examples is retailers using crime data to estimate the impact of shrink on store-level profitability. Some retailers will use the data to adjust projected shrink, while others will use it to assist with store designs, such as adding more surveillance cameras or eliminating blind spots in the store.”

According to the National Retail Federation’s 2022 National Retail Security Survey, the average shrink rate in 2021 was 1.44%, representing $94.5 billion in losses. By incorporating crime risk data into their site selection process, retailers can potentially reduce these losses significantly.

Real estate implications

The CrimeRisk dataset can be utilized in multiple ways within the KLI platform for real estate research and planning:

- Single Site Analysis: Analyze crime immediately around a potential site. If the crime rate is higher than that of your average store, decide whether to pass on the location or implement enhanced security measures.

- Bulk Site Assessment: When reviewing asset prevention and loss prevention budgets, crime indices can assist with prioritizing locations for proper budget allocation. This is particularly useful when evaluating multiple sites for presentation to a Real Estate Committee.

The 3rd Street Promenade in Santa Monica, California, a car-free, open-air mall, has historically been fully leased with national retail and restaurant tenants. While the decline of the Promenade isn’t completely associated with crime, homelessness and crime have been a big factor in major retailers leaving the area.

This KLI screen capture illustrates what a user would see when evaluating a new location on 3rd Street at a zoomed out level.

Data-driven decision making: A necessity, not a luxury

In today’s challenging retail environment, data-driven site selection is no longer optional. By incorporating comprehensive crime risk data into their decision-making processes, retailers can:

- Make more informed site selection decisions

- Allocate security resources more effectively

- Potentially reduce shrinkage and associated costs

- Enhance overall store profitability and longevity

As the retail landscape continues to evolve, those who leverage data effectively will be better positioned to thrive in the face of ongoing challenges.