Professionals in the world of retail real estate can easily describe the differences between traditional supermarkets and specialty grocery chains, either theoretically or anecdotally. We all know that specialty grocery chains like Trader Joe’s, Whole Foods, or the Fresh Market will often locate in affluent trade areas with healthy household incomes. There have been plenty of empirical studies from academia that indicate wealthy affluent consumers are most likely to shop at specialty grocers. These consumers are after food goods that are organic, healthy, local, trendy, eco-friendly, ethically sourced, or some combination of all of these attributes. Specialty grocery chains also tend to offer an elevated shopping experience over traditional supermarkets or discount stores.

Because intuiting the key differences between specialty grocery chains and traditional supermarkets is a simple exercise, little effort has been made from scholars or practitioners to dig into the more nuanced differences between these ubiquitous grocery formats. To explore these differences further, we designed a statistical model to help us understand how the composition of trade areas differs between specialty grocers and traditional supermarkets. We contrast these trade areas through three key dimensions: geodemographics, consumer lifestyles, and the competitive landscape.

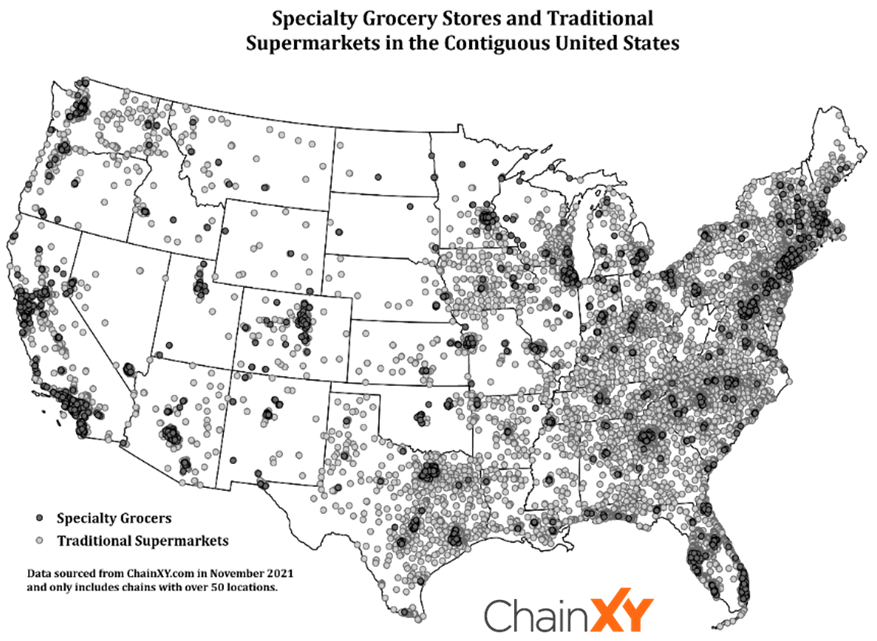

Our study began with a sample of over 16,000 grocery stores across the contiguous United States. These store locations were pulled from ChainXY in November 2021. For each store location, a drive time engine from SiteWise Analytics was used to cast 10-minute drive time polygons around each store to approximate a trade area. We then pulled a suite of demographic, behavioral, and competitive data for each store trade area. Geodemographic data included population density, percent black, median age, median household income, percent of the population with a bachelor’s degree or higher, and average household size. Consumer lifestyle variables include percentage of commuters walking or biking to work, and the number of health and fitness establishments (gyms, fitness studios, vitamin/supplement stores) in the trade area. For competition, we pulled the distance of the store to the nearest supercenter (Walmart or Meijer), distance to nearest wholesale club (Costco, Sam’s Club, or BJ’s), competitive saturation, and competitive mix. We define competitive saturation as the number of competing supermarkets and specialty grocer locations per 100,000 population.

The results of our model offer a much richer understanding of the differences between specialty grocer trade areas versus traditional supermarkets. Some salient findings are provided below:

- Controlling for other factors, as the median age of the population in a given trade area increases by 1 year, the probability that the observed trade area belongs to a specialty grocer rather than a traditional supermarket decreases by 0.43%

- Controlling for other factors, as the percentage of commuters traveling to work on foot/bike in a given trade area increases by 1%, the probability that the observed trade area belongs to a specialty grocer rather than a traditional supermarket increases by 0.29%

- Controlling for other factors, as the number of health and fitness establishments in a trade area increases by 1 unit, the probability that the observed trade area belongs to a specialty grocer rather than a traditional supermarket increases by 0.15%

- Controlling for other factors, as the competitive saturation in a given trade area increases by 1 unit, the probability that the observed location belongs to a specialty grocer rather than a traditional supermarket increases by 1.27%.

These results tell us, crucially, that specialty grocers are targeting consumers living certain lifestyles, and that they are certainly not afraid to put the gloves on to compete in competitively saturated trade areas. These model results are informative for any grocery chain thinking critically about competitive defense and market strategy. These findings are also particularly valuable for shopping center developers and planners who may be interested in attracting specialty grocery chains to their markets.

The full publication in Applied Geography may be accessed here: https://authors.elsevier.com/c/1hNRIWf-BMBuo

Recent Comments