Many site selection analysts continue to cling to using the total population within an expected trade area as the primary indicator of likely demand at a location. In our view, this often introduces error in forecasts because total population is rarely the best measure of demand. The obvious example is when the trade area includes a large group quarters population who happen to be guests at the state penitentiary and are, sadly, somewhat unlikely to be customers.

One of the more overlooked elements of total demand is tourism. The importance of tourism is highly variable depending on the particular type of retail or consumer facing business. Tourists rarely buy a new car, but they most certainly can play a major role in the success of restaurants and bars, and depending on the type of tourist, on grocery and convenience stores.

Some years ago, we were approached by a grocery store chain, who had paid a lot of money for a store sales model that simply didn’t work for some sites. We took one look at it and realized that the model was grossly underpredicting store revenues in beach towns and areas with lots of seasonal use homes. Adding just a couple of variables to the model to account for the tourism effect greatly improved the accuracy of the model.

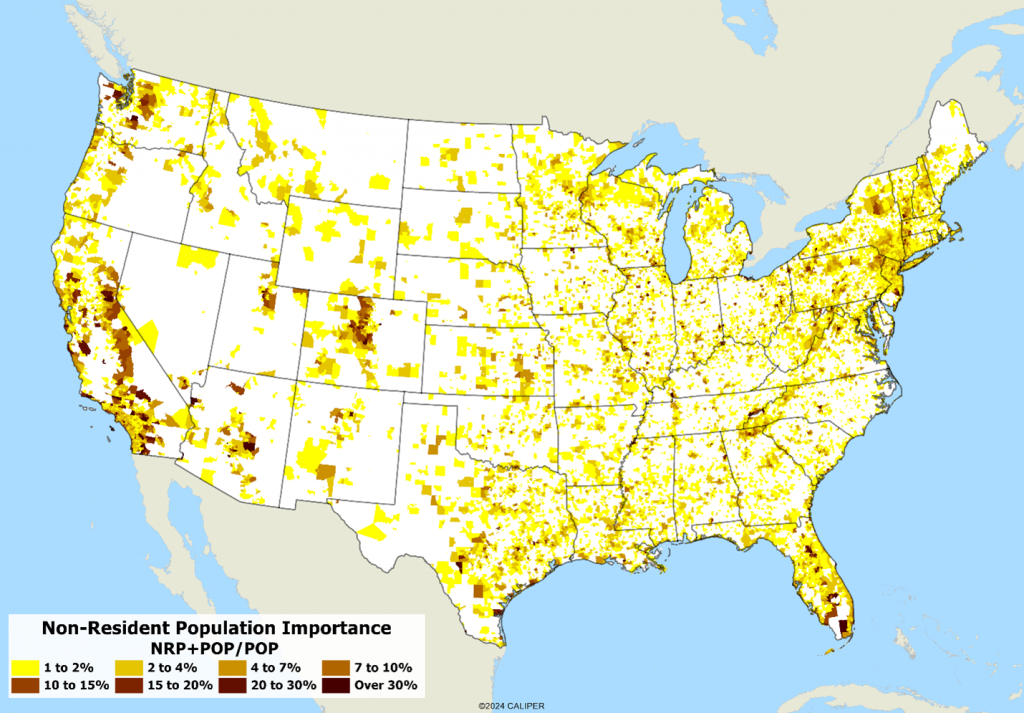

So how important is tourism’s effect? To measure this, we looked at the percentage increase in population when overnight leisure tourists were included. As a measure, this can be problematic because some tourist areas – national parks in particular – have few local residents. But overall, we see that the relative effect of tourism is dramatic, even in this smoothed view where we mapped 3 mile radius trade areas centered on each block group.

Relatively speaking, the highest tourism influenced areas are places like the Sierra Nevada range in California, much of the Florida Peninsula, and skiing areas in the mountain west and New England. But when we get a little closer, we see significant local effects in major metropolitan areas like Los Angeles and New York which should be accounted for in the site selection process.

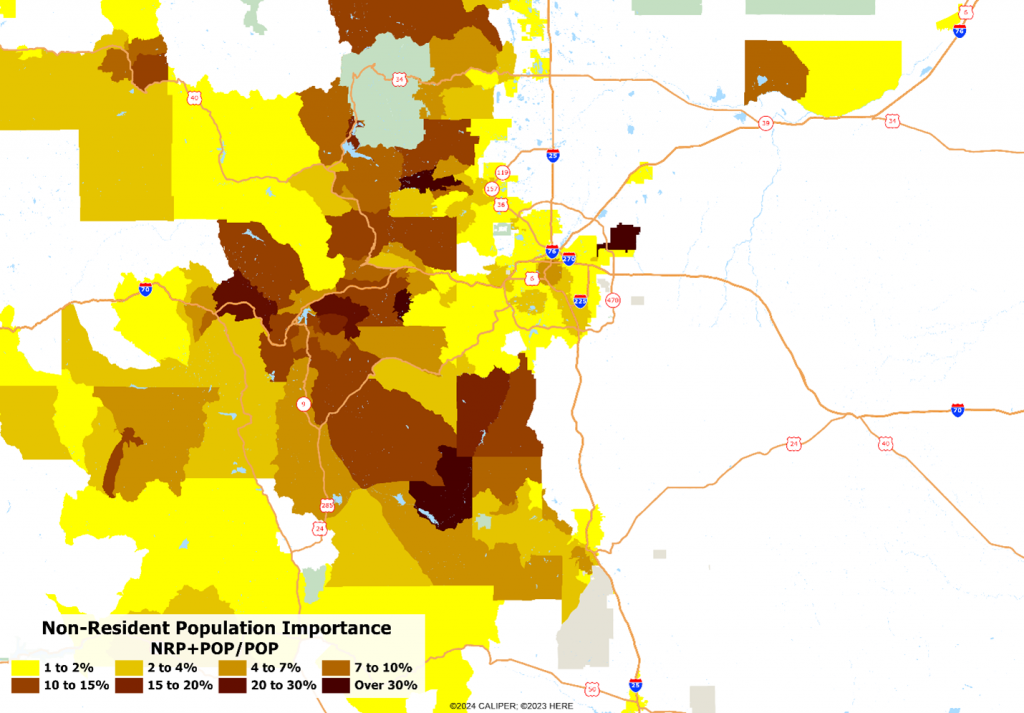

In the Denver area, the mountain resorts are clearly heavily tourism dependent:

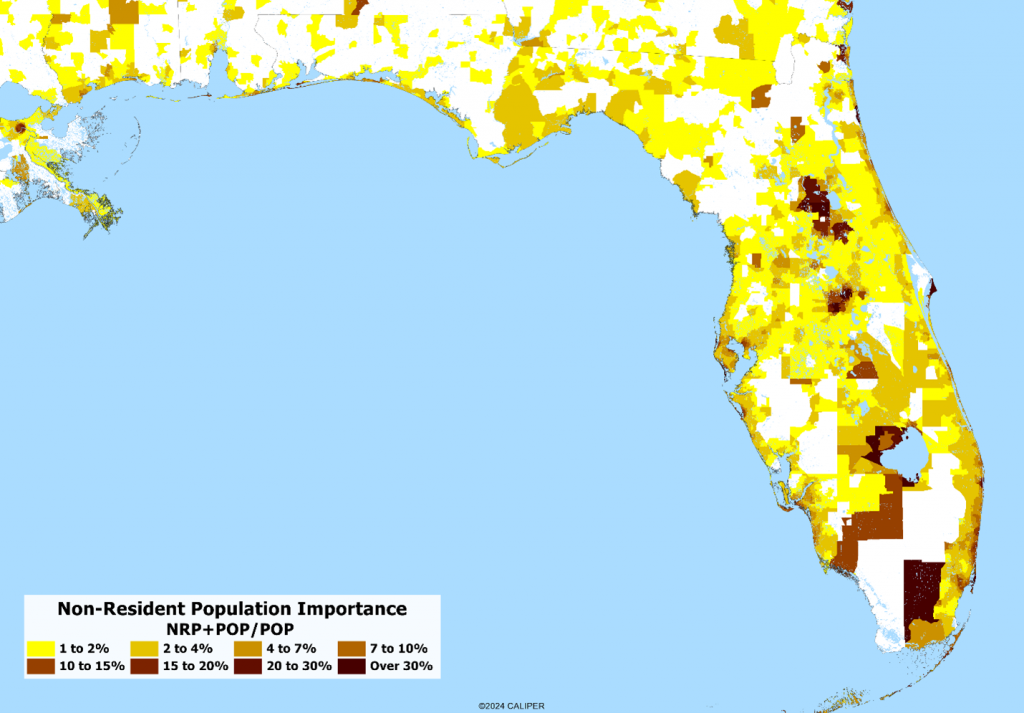

In Florida, the Orlando area obviously stands out, but any area within 10 miles of the coast should account for the tourism impact:

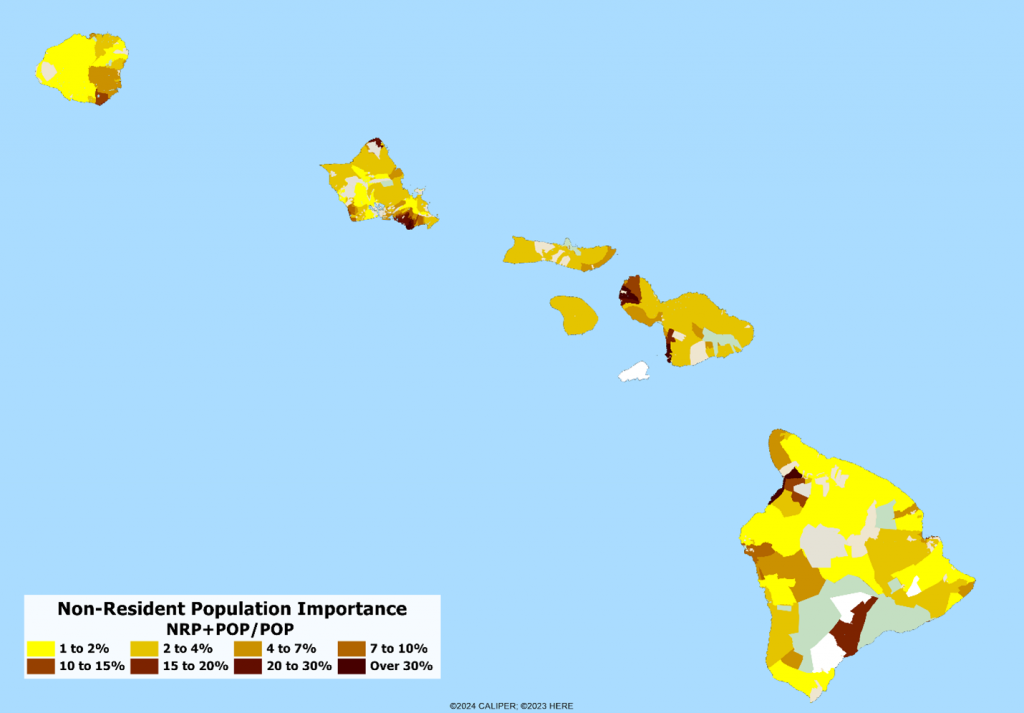

Hawaii has many areas where tourism is not a factor, especially on the big island, but has highly variable impacts even on the major tourist islands of Maui and Oahu.

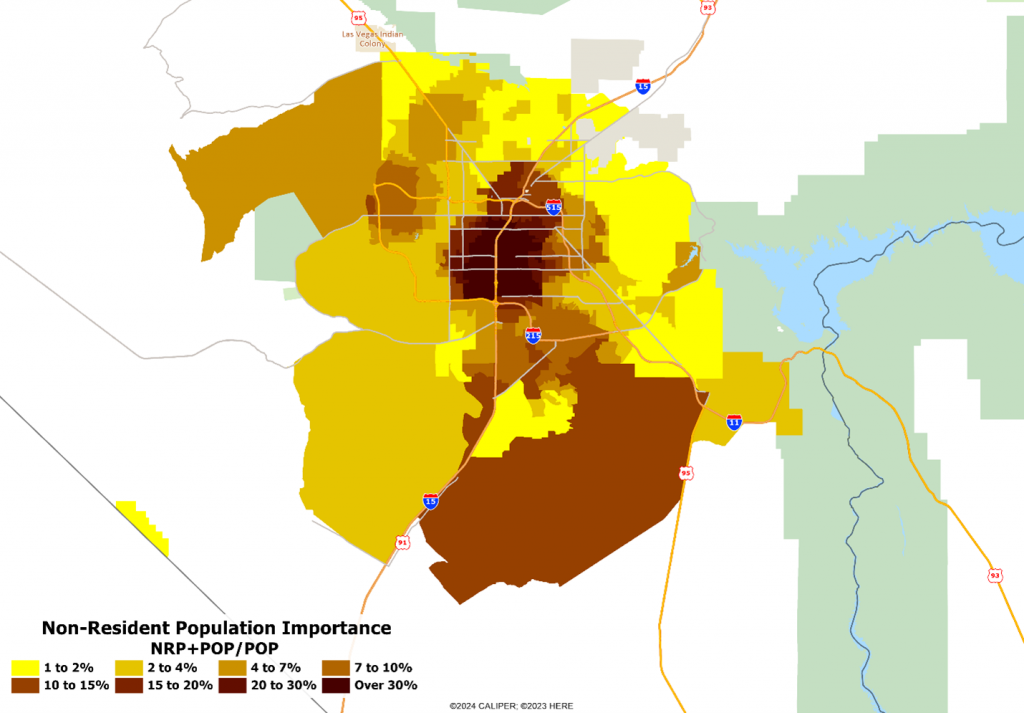

Las Vegas, considered one of the biggest areas for tourism, is highly dependent on tourists to sustain the local economy.

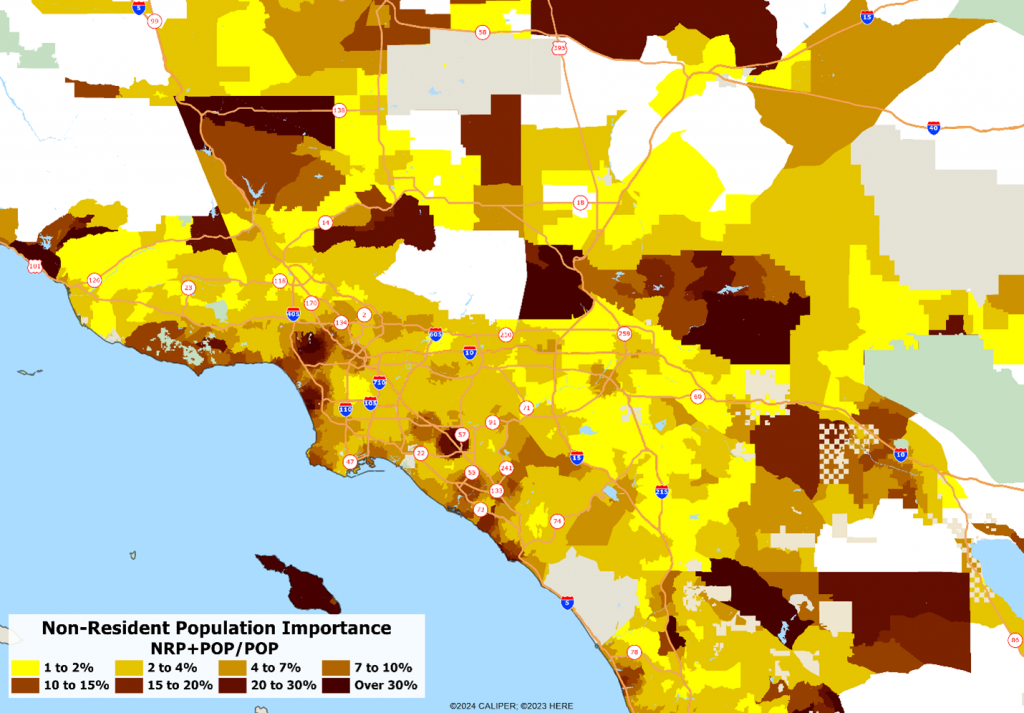

In Los Angeles, the patterns are largely as expected – beach towns, Catalina, Disney, Palm Springs, and the San Gabriel mountain resorts –but do consider that the impact can be felt in communities not normally considered to be tourist destinations – for example, the towns from Calabasas to Thousand Oaks are located a convenient 20 minute drive from the beaches of Malibu and have a surprisingly high tourist supply.

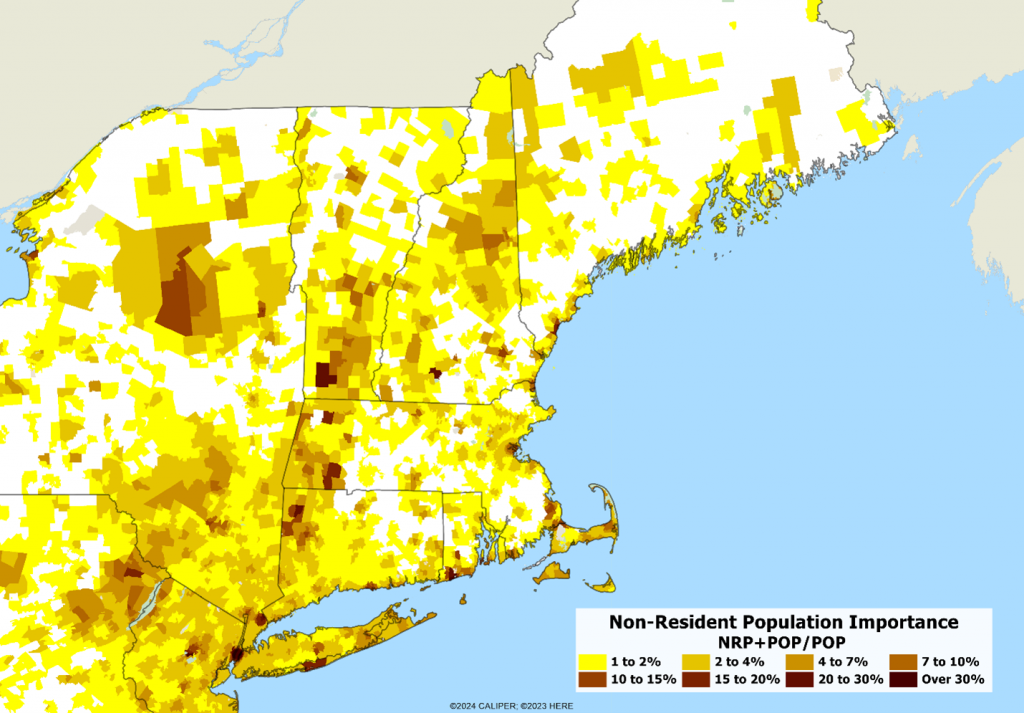

Finally, in New England, we find substantial areas within a couple of hours of New York and Boston that are highly tourist dependent:

The bottom line? If you are in a retail/consumer sector which attracts tourist demand, you need to account for non-residents in your site selection models. The AGS seasonal model is a highly sophisticated one which first asks the question “why would anybody come to this location as a tourist at this time of year?” Only then do we consider where the accommodations actually are – because different types of tourists also matter. Campers and RV tourists are quite different from those who camp at the local Mariott hotel. At AGS, we also like to document (Non-Resident Population – Applied Geographic Solutions) so be wary of estimates that don’t tell you how they were calculated.

Accurate forecasting requires accurate and extensive data, so don’t settle for simple models that don’t account for demand, or don’t filter out those who aren’t part of your target market.