The goal of many middle-aged workers in years past was to hit the corporate retirement age of 65 and find the nearest exit. Not long ago, many companies had, and enforced, mandatory retirement policies. Maybe it started with the Walmart greeter phenomenon, but today an increasing number of seniors are continuing to work well beyond the magic number and into their seventies.

Retirement, in the grand scheme of history, is a recent concept. Prior to the introduction of government managed retirement benefits, the age of 65 had no particular meaning. Social security in the United States was designed to provide benefits for what was expected to be a short period of time, but as life expectancy for seniors has risen over the decades, most reasonably healthy mid-60’s people can expect at least fifteen to twenty years of life. Most private companies no longer have mandatory retirement policies.

Many these days have no particular interest in retiring because they enjoy their work, interactions with colleagues and clients, and because the concept of sitting about watching the world go by doesn’t appeal to them. Others have simply not saved enough funds to retire comfortably or have had inflation eat at their purchasing power. In a recent CNBC survey (https://www.surveymonkey.com/curiosity/cnbc-financial-literacy-2023/), nearly half of the respondents said that they weren’t saving enough money to retire at their target age. With recent inflation, many are postponing retirement in the hopes of stretching their resources out.

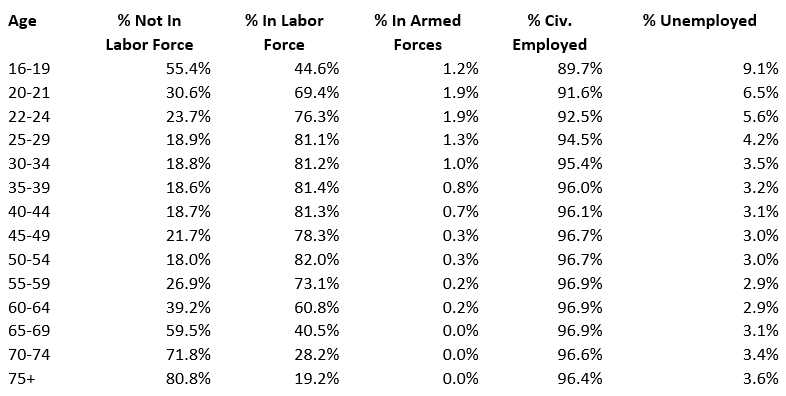

We recently added labor force status by age to our extended current year estimates series, and the results are quite interesting:

Labor force participation rates drop from 60% (age 60-64) to 40% (age 65-69) and drop to 20% for those over the age of 75. These are surprising numbers, especially since this generation was raised on the stories of the coming leisure society.

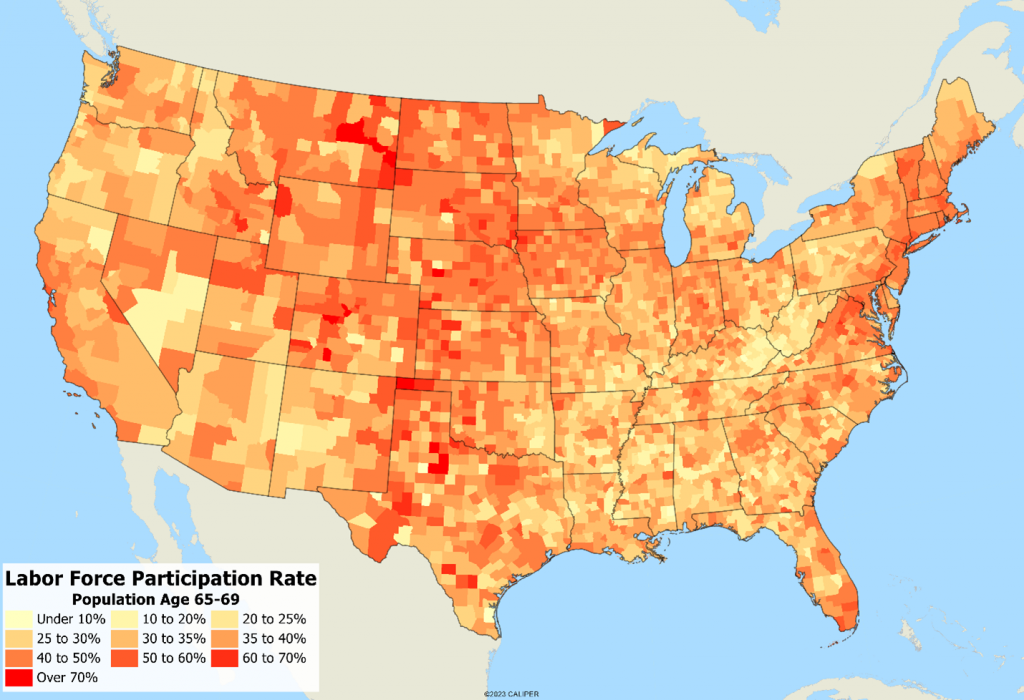

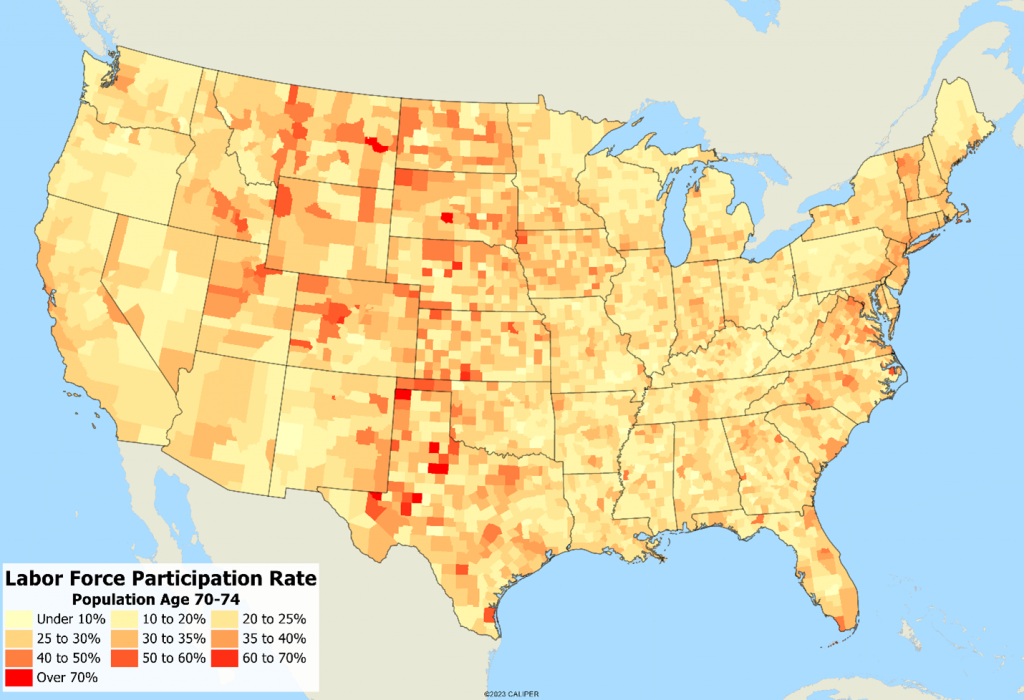

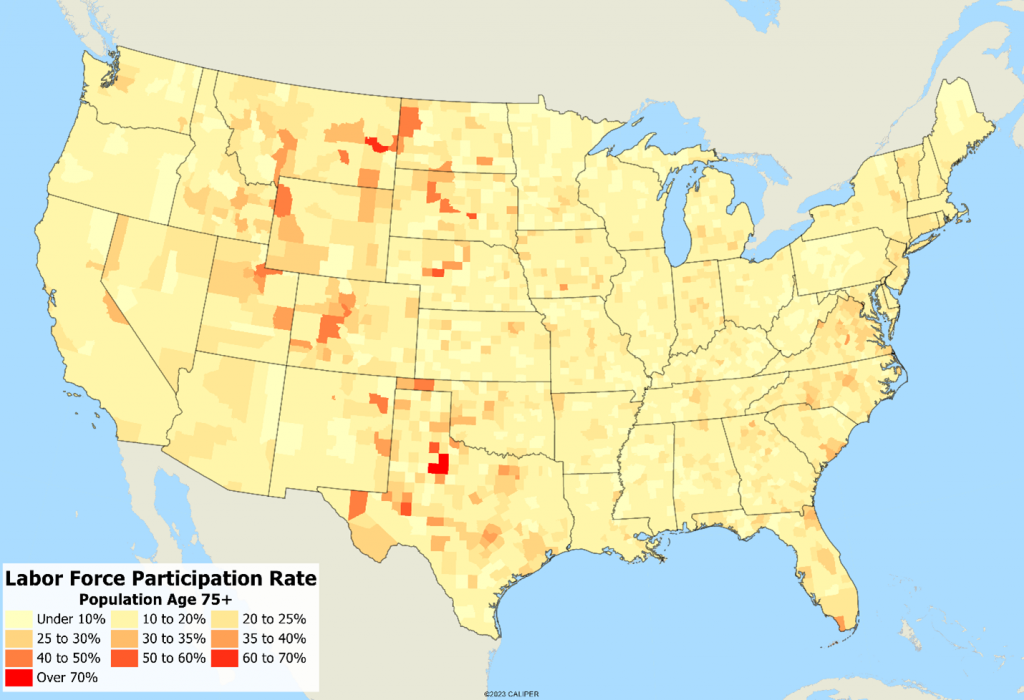

If we map these out – we can see that senior labor force participation is highest in rural areas, but we also suspect that self-employed people are less likely to retire. Given that part of our company name is ‘geographic’, we of course mapped this out to show the spatial patterns of the decline of labor force participation in the ‘retirement’ years:

Recent Comments