We recently asked our friends at ChainXY (www.chainxy.com) for the location data on selected retail chains in Texas in order to undertake some comparative analysis of the site signatures and risk profiles of each.

The locational strategies of each retail chain have impacts on their risk profile and therefore on their risk abatement strategies. While most major chains have locations in both relatively low and high risk areas, we were interested first in the overall risk profile of each chain. Retailers are generally concerned with the minimization of theft losses and the protection of both consumers and employees. Stores in high risk locations merit greater levels of security, and many chains employ a classification of stores in terms of risk levels, each with its own mitigation strategy.

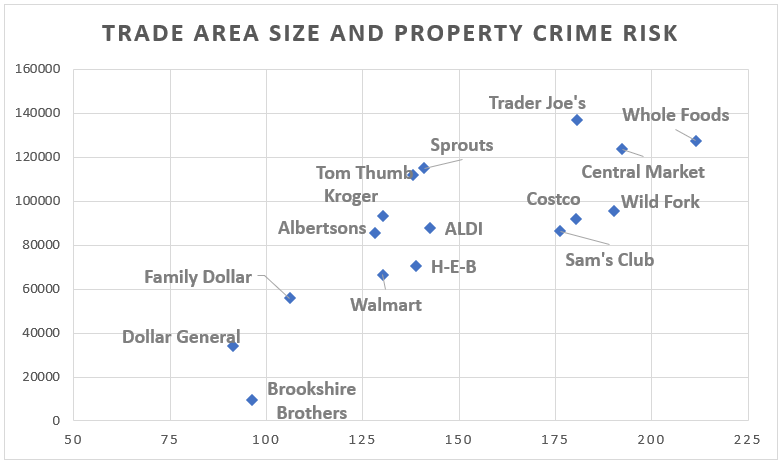

The chart below shows the relationship between trade area population and property crime risk for selected grocery and related stores in Texas. Some of these chains largely avoid the larger metropolitan areas where crime rates tend to be relatively high, while others have large urban trade areas and significantly higher risk profiles. This is especially true of the more upscale chains such as Central Market, Whole Foods, and Trader Joe’s:

Perhaps surprising is the relatively high crime risk associated with Wild Fork locations, given that the chain is a recent specialty entry into most markets, although with only ten Texas outlets, the average is easily skewed. The chain with the lowest property risk? Dollar General.

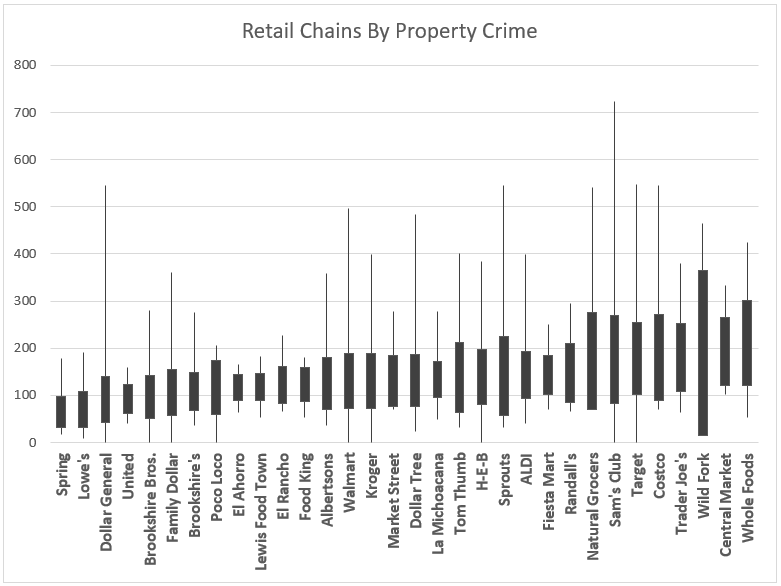

The chart below shows selected retailers sorted by ascending average property crime. The thin lines show the maximum and minimum for the chain, and the thick bars show the standard deviation from the mean.

It is interesting that while Dollar General has at least a few locations in high crime risk areas, the standard range is narrow in comparison to chains with a more urban orientation such as Whole Foods and Sam’s Club. Central Market and Whole Foods, both catering to upscale shoppers, have a high average, but their maximum risk stores are much lower than chains such as Sam’s Club, Target, and Costco.

Retail losses from theft have been justifiably in the spotlight over the past couple of years, and retailers are increasingly turning to a data-driven mitigation strategy that includes a tiered approach that invests heavily in high risk sites in order to discourage theft and to ensure the safety of both customers and employees.

Recent Comments