The ‘business demographics’ of an area are important to location analysts because they can be used to enhance sales estimates and because they can be used to assess the competitive landscape.

Twenty years ago, the demographics of businesses were well behind residential demographics in terms of accuracy and completeness – mainly because of the efforts of the census bureau to enumerate populations for both apportionment and policy formulation. The sources of business data were often woefully lacking for both small firms and multi-locational firms.

There are a few sources of business data that are readily and freely available, and each has significant limitations:

- The Census Bureau releases its annual County Business Patterns file, which is good for larger firms but weak on small firms and especially non-incorporated businesses. The county geography is not particularly useful for large counties, and for small counties much of the detailed data is suppressed. It can be supplemented with the preliminary file for each year, which is at a ZIP code level but has little detail beyond firm size. Users of the ZIP code file should be aware that it is released ‘as is’ and has not been cleaned or standardized.

- The economic census series is undertaken every five years and provides more detailed summaries by sector but suffers from time lag and significant data suppression.

In the late 1990’s, we at AGS used these sources as the basis for estimating our business demographics data at the block group level. They were, if we are honest, rather crude estimates at best when you looked at the sectoral breakdown of firms in any detail.

The remedy is to utilize list data (there are several alternatives) which provide the geographic detail missing from the census products. Most are oriented towards direct marketing where the overall response rate is key, not the locational details of individual establishments. They tend to be sticky – meaning that firms which have closed or relocated often show up in these files until another business is found at the same address. Other lists tend to be oriented towards corporate credit scoring and may be uninterested in the locations of non-headquarters facilities.

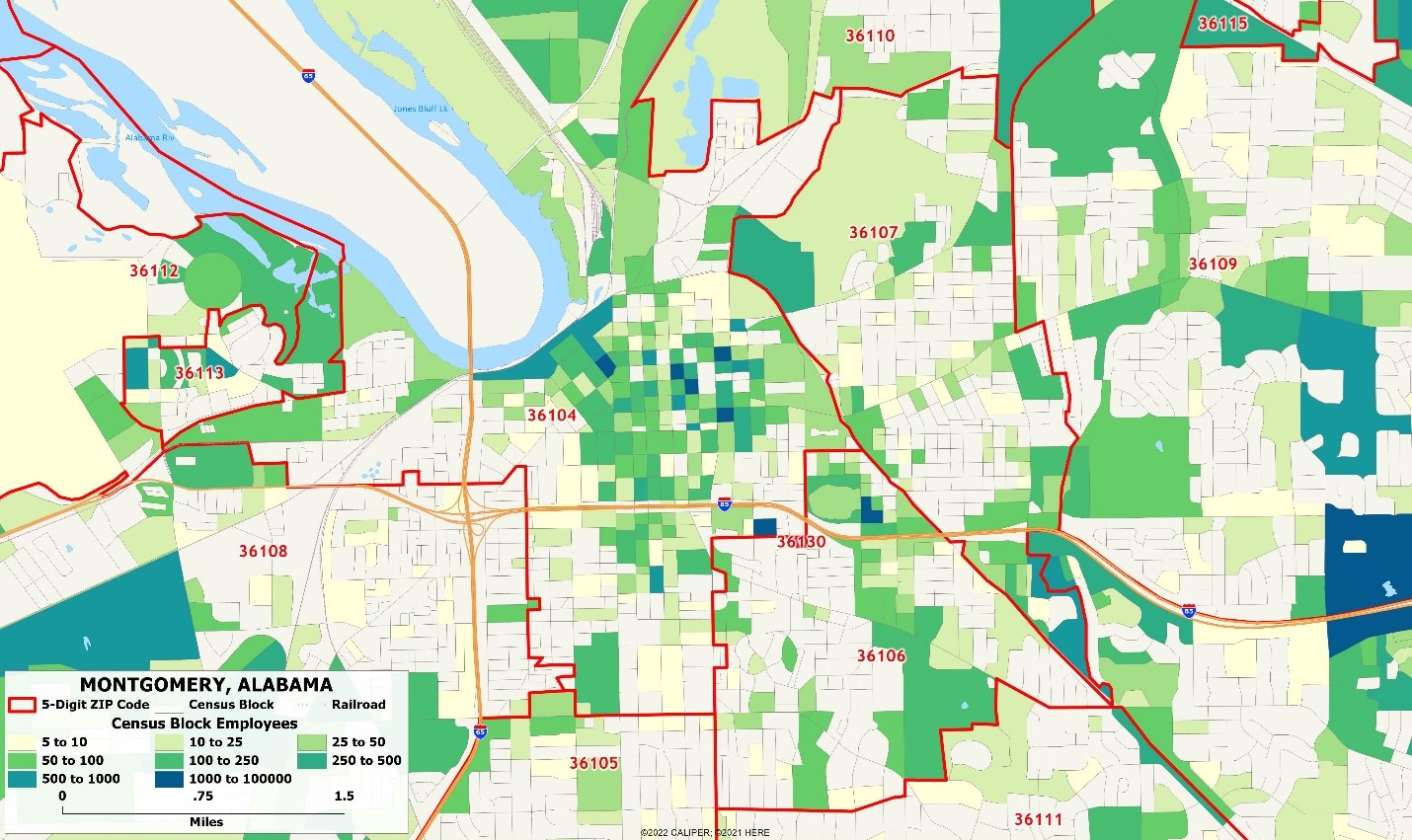

The key is to utilize a list which is itself the marriage of multiple lists. This improves the coverage of small firms and multi-locational businesses. The list data can then be summarized at the census block level by detailed NAICS codes. Once aggregated, they can be compared and adjusted to conform to the data found in the census sources. The business landscape is extremely complex – and even the use of ZIP code level data from the County Business Patterns can be risky:

For competitor analysis, especially in the dynamic retail and restaurant environment, you may need to go one step further and acquire the most current location data for one or more of your direct competitors. As usual, you have choices and AGS is always happy to point you in the right direction and make introductions for you.

Does your demographics vendor simply apportion business data from the county and ZIP code level for radius and drive time studies? If so, those estimates can be wildly inaccurate and lead to poor locational decisions. Check the sources that are referenced, and make sure that you aren’t misinterpreting the precision and accuracy of your business and daytime population estimates.

Recent Comments