In modern political discourse, there are often promises to help the working poor by increasing the minimum wage. In California, the recently enacted minimum wage law for fast food workers has been the subject of some discussion. Unlike most minimum wage laws which affect all sectors equally, this one applies to just the fast-food industry. What impact is this having in California, and how will it impact consumer spending?

The Federal minimum wage is currently $7.25, but in California, it is $16.00 per hour except for fast food and, effective June 1, “Healthcare Facility” workers, where the minimum wage is now $20.00 per hour. In addition, many counties and cities have enacted their own minimum wage laws, and this results in a myriad of headaches for businesses active in the state. The minimum wage in the City of Los Angeles is $16.78, but in unincorporated areas of Los Angeles County, it is $16.90 (see https://laborcenter.berkeley.edu/inventory-of-us-city-and-county-minimum-wage-ordinances/#s-2). Making matters more complex, any chain with over 60 locations nationwide is subject to the rule, even if 59 of them are outside their jurisdiction. So, a fast food chain with 59 locations nationwide must by law pay a minimum wage of $16.00, but that increases to $20.00 with just one additional location.

The minimum wage laws for fast food workers went into effect on May 1 of this year and were immediately met with both menu price changes and worker layoffs. In-n-Out pricing increased by between $0.25 and $0.50 for the flagship double-double burger. Several other chains announced significant layoffs, while others openly discussed using offshore order takers for their drive-through windows.

What it boils down to is this. The cost of your double-double is composed of (among other things) the costs of labor, materials, premises, and marketing plus a profit for the company. When you, by decree, increase the relative cost of labor in the finished product, there are two reasonable responses – increase the price or decrease the amount of labor. So, it shouldn’t surprise anybody that both responses have been seen.

The net effect is that the remaining workers are financially better off, at least in the short run. Those laid off will see work in sectors not regulated by the $20 rule, creating a surplus of workers and keeping wages lower in those other sectors. The $20 rule for one particular type of business is not neutral to other workers – it may cause wage growth in those sectors to be slower.

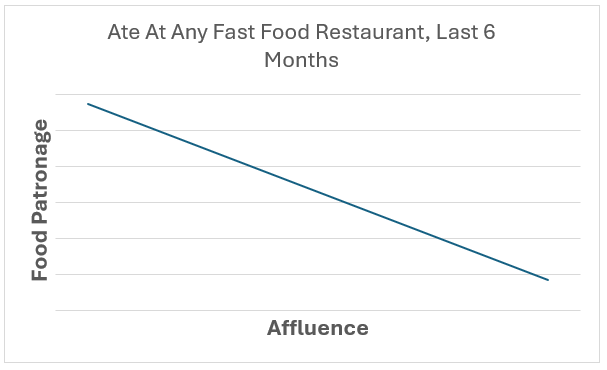

Worse yet? The ‘working poor’ tend to spend a much higher proportion of their income on fast food than do more affluent households. Patronage at fast food restaurants diminishes with affluence (MRI-Simmons Doublebase 2022-2023):

Expenditures at fast food restaurants vary little when both family size and income are analyzed using the Consumer Expenditure Survey (2022, Bureau of Labor Statistics), in that households with low income tend to spend almost the same amount per person annually as do affluent households.

So, as is often the case when governments intervene in free markets, the actual impacts are quite the opposite of what was promised. The remaining fast food workers after layoffs are at least temporarily better off. Everybody else isn’t. Over time, the sector minimum wage will become the effective minimum wage for all sectors, since those in other sectors risk losing workers to the fast food industry where wages for similarly skilled work are higher.

Over the long term, the relative value of flipping a burger didn’t change, so the adjustments will ripple through the state economy. At the end of the day, nobody is better off, except those who flee the state for less interventionist governments.