Just over 30% of adults in the U.S. own any kind of security, but that topline figure conceals deep differences in who is investing — and what they’re putting their money into. From safe bets like annuities and CDs to edgy plays like cryptocurrency, investment choices often come down to one key question: how much risk are you comfortable with? We looked at data from 2025A to find out who the investors are.

The answer seems to vary sharply by age, affluence, and lifestyle — and there may be no clearer example of that divide than when comparing annuities to cryptocurrencies.

Among all security types, the most common investments are:

- Mutual Funds (Stocks) – 11.4% of adults

- Common Stock (Other Companies) – 10.5%

- Money Market Funds – 7.5%

- U.S. Savings Bonds – 7.4%

- CDs (Over 6 Months) – 5.4%

Cryptocurrency sits near the bottom, with just 3.3% of adults invested. But that low number hides a highly concentrated and demographically distinct investor base.

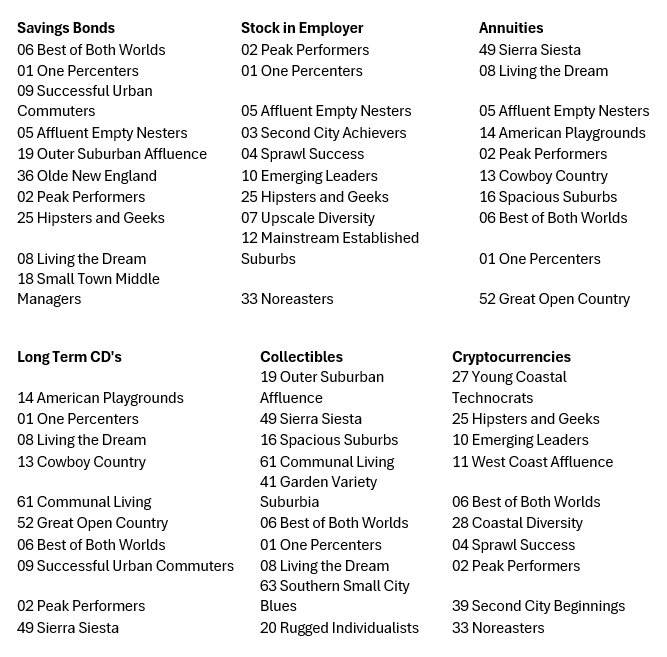

How do the demographics of these buyers differ? As you would expect, the most affluent Panorama segments tend to be among the highest investors of all products – 01 One Percenters show up in most of the top 5 segments lists for these individual products. But there are some major differences:

- The more affluent segments tend to be more diversified in their securities holdings, dabbling in pretty much everything from the safest (annuities) to the riskiest (Commodities, puts, and calls)

- Younger segments, some affluent, some not, tend to be more focused on high risk / high reward investments like Cryptocurrencies and owning shares in the companies they work for

- Older segments tend to focus on safer investments – annuities, bonds, long term CD’s

- The least affluent, while less likely to hold securities at all, tend to hold collectibles and precious metals, and dabble in Cryptocurrencies

The chart below breaks down which segment is most likely to own which investment type.

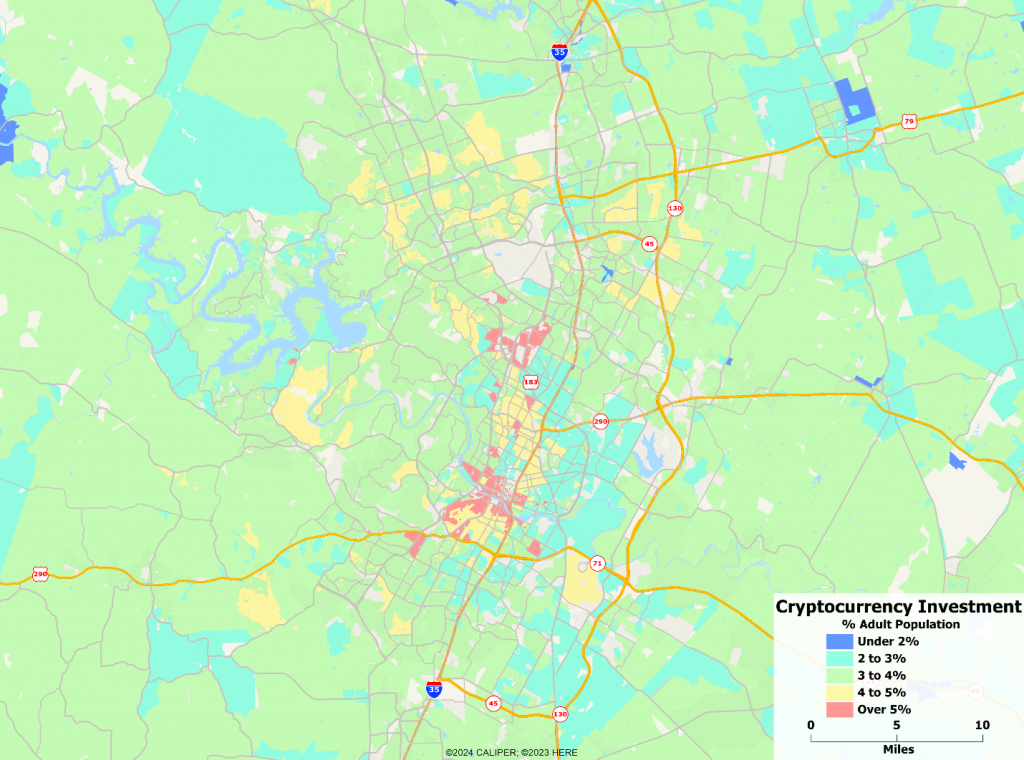

Who’s Betting on Crypto? While traditional investments tend to skew toward older, affluent Americans — such as the “One Percenters” or “Affluent Empty Nesters” — cryptocurrencies are firmly the domain of the young and educated. These groups, like 25 and 27, are digitally savvy, often live in urban tech hubs, and are comfortable with volatility in exchange for high upside.

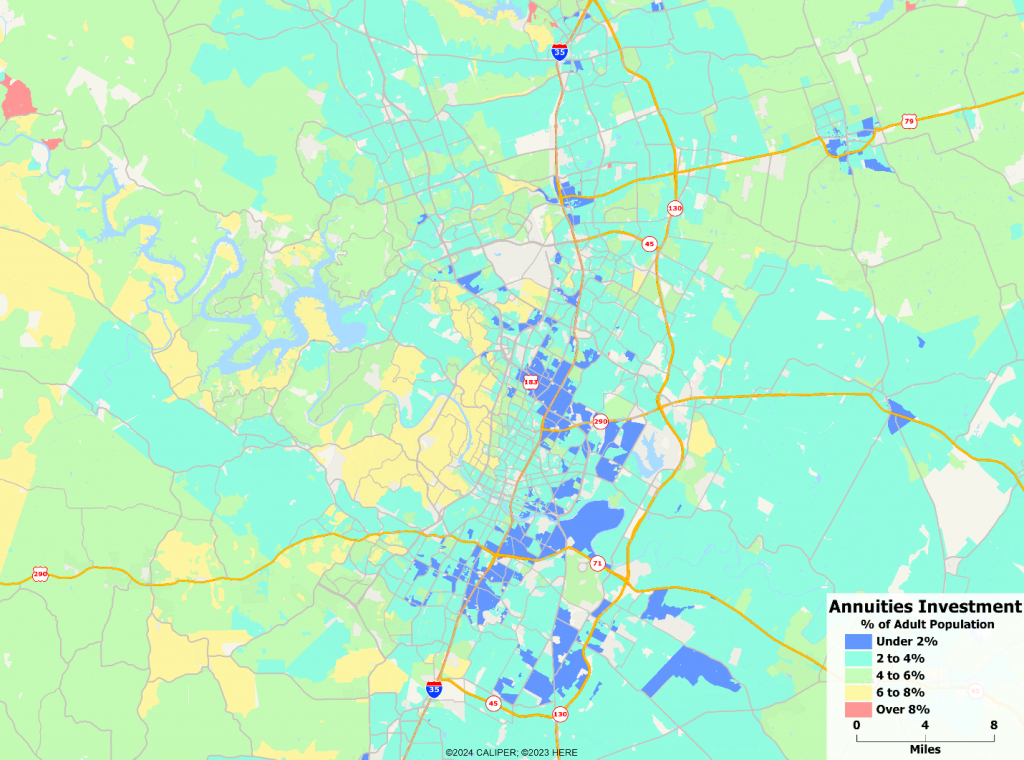

Two maps of the Austin metro area bring these investment preferences into sharp geographic focus. Map 1 shows those that invest in annuities. Investments cluster in the southern and eastern suburbs — areas that tend to be older and more conservative. These neighborhoods light up in darker blue, showing 6–8%+ annuity participation among adults. Map 2 shows Cryptocurrencies. Investment is strongest in central Austin and surrounding inner suburbs. These red and orange hot spots align with the city’s younger, more progressive tech population — places like East Austin, Mueller, and areas near UT.

This geographic divide mirrors broader national trends: the more traditional the investment, the more it skews older and suburban; the riskier and more novel, the more it’s embraced by the young, urban, and tech-forward.

Recent Comments