As demographic shifts ripple across the U.S., the multifamily housing market is evolving in response. From declining fertility rates to a surge in apartment construction, understanding the interplay between population trends and housing demand is key to making smart real estate decisions.

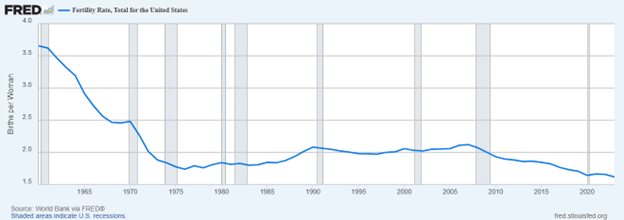

The long-term trend in fertility is unmistakable: U.S. birth rates have steadily declined over the past few decades. Age at first marriage has also been increasing steadily since the 1950s, when the average age was 22 for males and 20 for females. By 2023, those numbers had risen to 30.2 for males and 28.6 for females—meaning roughly half of men are in their 30s when they marry. With people marrying later, they are more likely to delay or forgo having children entirely. Fertility rates reflect these shifts: as the chart below from the Federal Reserve Bank of St. Louis shows, today’s birth rate sits well below the replacement level.

Chart source: The Federal Reserve Bank of St. Louis (fred.stlouisfed.org/series/SPDYNFRTINUSA#)

This isn’t just a cultural trend—it has real implications for housing. Smaller families mean demand is tilting away from large-lot single-family homes. Fewer bedrooms, less yard space, and walkable, lower-maintenance environments are increasingly in demand.

One result of these demographic changes is a shift in the ratio of people to dwellings. With more households made up of one or two individuals rather than families of four or more, housing demand grows even when population growth is modest. The big, sprawling suburban developments of past decades are becoming increasingly unsustainable. Infrastructure costs are high, and local governments are placing more restrictions on low-density expansion—through land use policies, permit requirements, and infrastructure fees.

In many areas, municipalities are not only making traditional sprawl harder to build, but they’re also actively incentivizing multifamily development. Tax breaks, zoning changes, and expedited permitting are being offered to developers who build smaller-scale apartments, townhomes, and mixed-use projects.

Developers are responding to demand from younger renters, aging downsizers, and cost-conscious families—all of whom are looking for walkability, convenience, and lower maintenance costs. The alignment is clear: as household composition changes, housing preferences shift in tandem towards denser, more efficient living spaces. We predict a shift towards multi-family units within new suburban developments, with many more small apartment buildings and townhouse complexes mixed in with single family homes – and even these are more likely to be smaller than in recent years. Often those apartment buildings will include commercial space on the first floor.

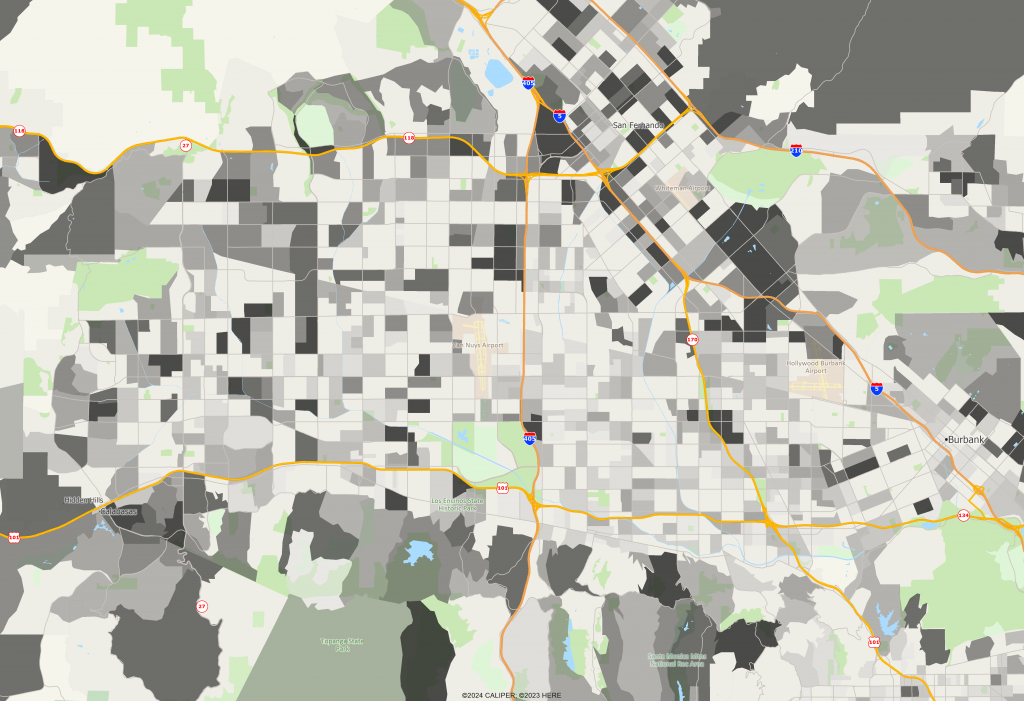

Los Angeles’ San Fernando Valley—long seen as the blueprint for postwar suburban sprawl—has undergone dramatic change. Many of the Valley’s original single-family neighborhoods from the 1950s and 1960s have been redeveloped into mid-size apartment buildings with 50+ units. This transformation has concentrated along major thoroughfares and freeway junctions. The map below shows the change in the percentage of dwellings that are in buildings with 5+ units from 2010 to 2025, with darker areas indicating more substantial change.

Nashville’s transformation is another compelling example. Over the last 15 years, growth has accelerated in and around the city, including suburban areas that traditionally favored single-family homes. Along the new I-440 beltway and at junctions with radial freeways from the downtown core—such as Franklin, Spring Hill, Murfreesboro, Lebanon, and Henderson—higher-density developments are increasingly common. As with Los Angeles, the map below illustrates the dramatic increase in apartments of 5+ units between 2010 and 2025.

For developers, this means ongoing opportunities in markets that are absorbing new units and attracting demographic segments aligned with multifamily living. For investors, understanding these drivers can help identify which submarkets are likely to see the strongest rent growth and occupancy in the years to come.

However, this poses challenges for AGS and other data vendors, since the style of development has fundamentally changed. The ACS sampling does not adequately capture these changes everywhere, and we are now relying on several very detailed sources in addition to those we have relied on in the past (such as the USPS and private delivery services) to try to track change, including:

- Parcel level changes that include corporate purchases, land subdivision, and property assembly.

- Monitoring changes in consumer address files – where we are looking specifically for changes at the block level in the number of separately addressable dwelling units by census block to identify redevelopment at a higher density

- Tracking building permits at the individual permit level

- Using AI based satellite image interpretation in selected areas to specifically identify types of changes in census blocks where other indicators suggest that significant change is occurring.

These strategies allow us to stay ahead of the curve and provide real estate professionals with data that reflects the true pace and nature of housing change.

Recent Comments