Late last week, an innovative scheme to attract new residents hit the wires. The city of Cumberland, Maryland, is offering a $10,000 payment if you will just move to their fine city and either buy or build a house there, and up to a further $10,000 in matching grants to renovate that house. While some restrictions apply, the goal is to induce remote workers to locate in the town (https://www.ci.cumberland.md.us/CivicAlerts.aspx?AID=1248).

The town currently has just over 19,000 residents, which is down dramatically from its peak of nearly 40,000 in 1950, but relatively unchanged since 2020. The town played a significant historical role in the westward expansion as the beginning of the ‘National Road’ which led settlers west to Ohio, Indiana, and Illinois. At present, it is home to a major hospital and state university campus but is also a significant tourist destination as it is convenient for those escaping major eastern cities for the Appalachian Mountains.

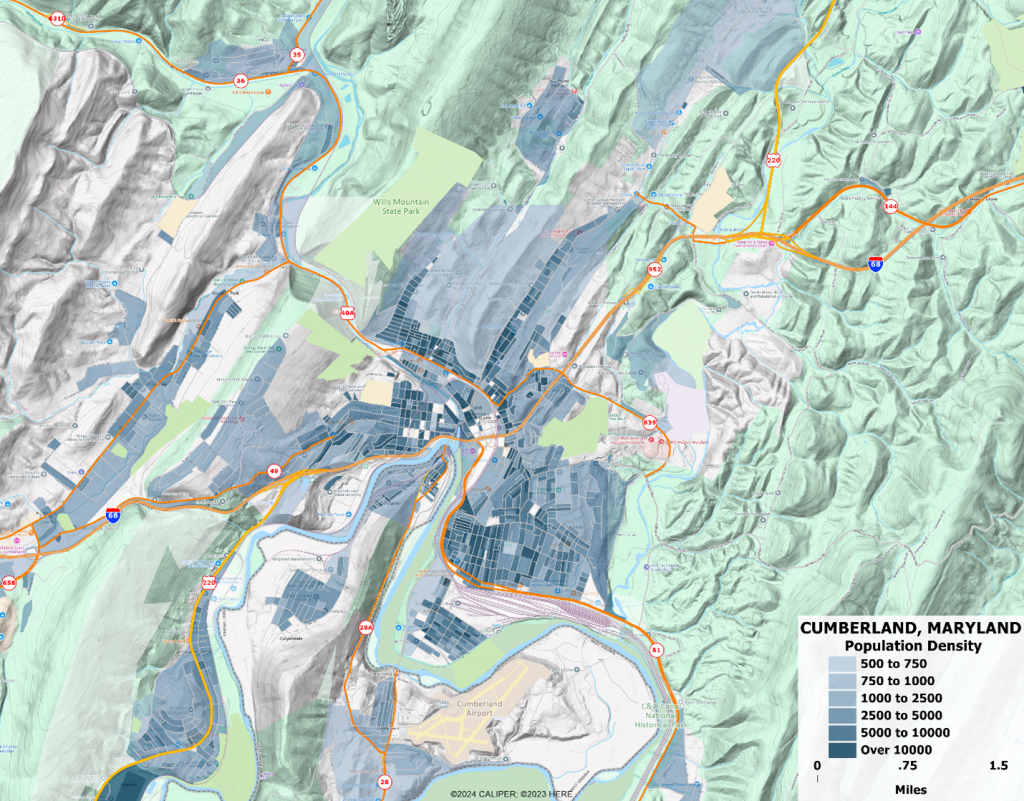

Those same mountains, however, have hampered the growth which has occurred in the counties directly east of the city which are reachable by commute to both Washington and Baltimore. The population density by census block is shown below, with areas over 500/square mile displayed over a topographic view:

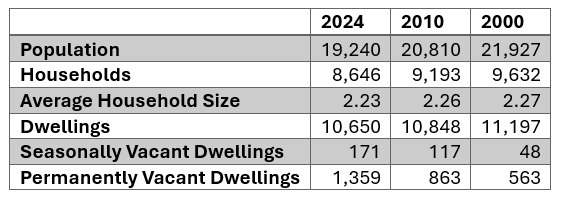

Some key statistics, especially in a historical context:

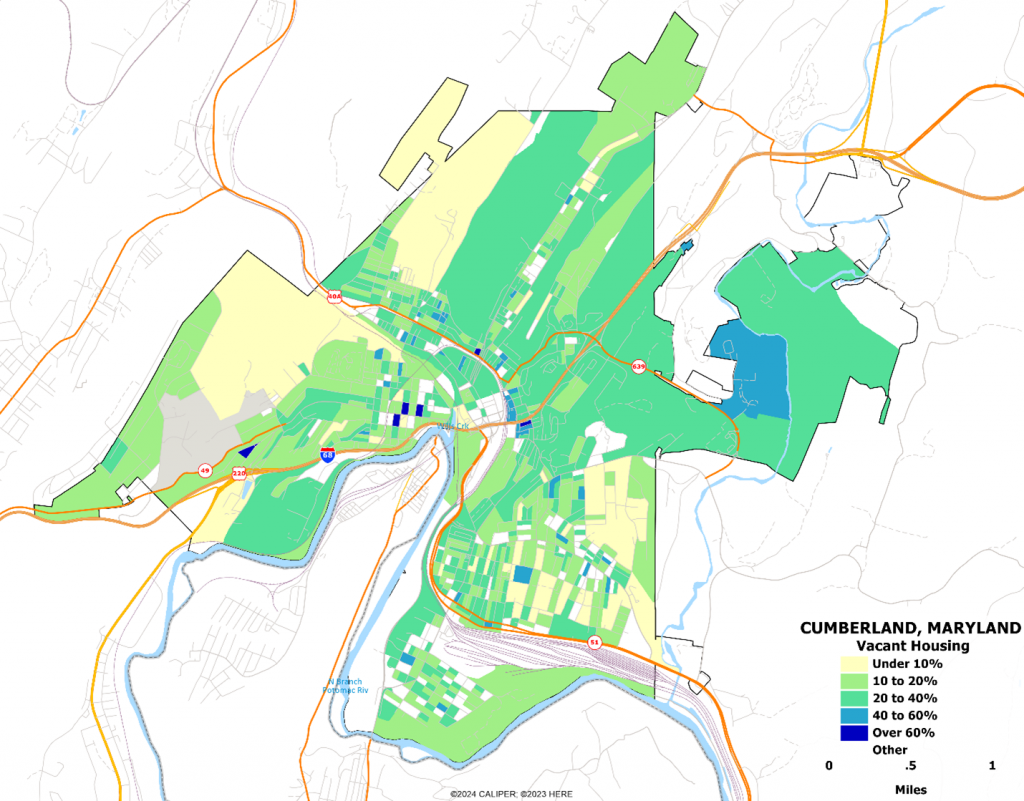

With approximately 1,000 fewer households than in the year 2000, the number of vacant houses has increased dramatically to 20% of the housing stock, with many areas well over 50%:

So, we understand the problem the town has. But what about the proposed solution?

Municipalities for many years have used tax incentives to attract businesses, and these often end in bidding wars where the result is that companies pay near zero property tax for a period of time. At the end of that time, many simply begin the process anew, demanding that these incentives be extended lest they flee for a new jurisdiction.

In many cases, bidding between municipalities which essentially offer the same infrastructure, labor force, and amenities merely lessens the tax benefit to the residents and may actually increase their tax burden, since the municipality is now on the hook for providing expanded services, while not having any more money to do so.

In the worst–case scenario, one which we fear probably occurs fairly frequently, the location decision is made despite significant locational obstacles because of said generous offer. In other words, the company is induced to locate to a site which is less than ideal, which weakens the company in the long run and may put at risk those very jobs the municipality was hoping to attract.

What about attempting to attract new residents who work remotely, as is the case here? We cannot see any scenario in which this is successful – how many of these new residents are going to buy on a block that has 50% vacant housing? If they build a new house, what is the length of time to return the investment via property tax? The city raises only $16 million through property taxes (roughly $1,600 per dwelling including the vacant ones), so the proposition is break even only after about 7 years. If they buy a vacant house and fix it up, the city is out $20,000 in cash, which would likely take at least 10 years to recoup. Meanwhile, even with state funds doubling the budget, the city runs a deficit every year.

In order to be even remotely successful, the program would have to convince people who were planning to move to a small town and work remotely to choose Cumberland over the alternatives. We suspect that those induced to put Cumberland on their list, then move it to the top, would be making poor location decisions which would eventually be corrected. They have the money but leave town in short order in any event. In other cases, which we suspect to be the vast majority, the household would have moved to the town in any event and are simply being given money by the current residents to do so.

The worst-case scenario is that the program does in fact work to some degree, in which case you could see competing municipalities playing the same game. This ends up distributing money paid by non-movers to movers and would encourage neighborhood instability as well as punishing their loyal customers (residents) by making them pay for it all. This is a truly terrible, and in our view, immoral program which we hope will be mocked rather than celebrated.

The best-case scenario? They just wanted a gimmick to get some media attention. Which they did, and hopefully this ends right here.