The 2024A data update will feature a completely redesigned and significantly improved ‘assets and debts’ database which we will be renaming as the Household Finance database.

The main features of the database include:

- Update to the 2022 Survey of Consumer Finances (SCF), which is released by the Federal Reserve every three years.

- Direct modeling of the survey at the individual response level using the AGS synthetic household model. This model uses multiple level relationships such as Tenure – Vehicles Available – Income to create estimates that preserve much more of the variation inherent in household level data that is often lost when modeling from survey summary statistics.

- Expanded coverage of asset sub-categories which now include detailed breakouts of many of the asset and debt classes, such as the distinction between mortgages and real estate secured lines of credit.

- Additional summary variables including late payments, bankruptcies, and debt-to-income ratios.

The following tabulations are available for both all households and just those reporting the particular asset or debt category:

| Category | Sub-Category | Elements |

| Financial Assets | Liquid Assets (Transaction Accounts) | Money Market Funds

Checking Accounts Savings Accounts Call Accounts Prepaid Cards |

| Certificates of Deposit | ||

| Directly Held Pooled Investment Funds (Mutual Funds) | Stock

Tax-Free Bond Government Bond Other Bond Combination Funds Other Mutual Funds |

|

| Savings Bonds | ||

| Directly Held Stocks | ||

| Directly Held Bonds | Tax Exempt

Mortgage-Backed Govt/Govt Agency Corporation |

|

| Retirement Accounts | IRA/Keough Tax Deferred

Employer Based 401k Future Pensions Currently received pensions |

|

| Life Insurance Cash Value | ||

| Managed Assets | Annuities

Trusts |

|

| Other Financial Assets | ||

| Non-Financial Assets | Vehicles | |

| Primary Residence | ||

| Non-Primary Residence | ||

| Other Real Estate Investment Assets | ||

| Business Assets | Active participation

Inactive participation |

|

| Other Non-Financial | ||

| Debts | Debt Secured By Primary Residence | Mortgage/Home Equity Loans

HELOC |

| Line of Credit, not secured by primary residence | ||

| Other Residential Debt | ||

| Credit Card | ||

| Installment Loans | Vehicle

Education Other Installment Loans |

|

| Other Miscellaneous Debt | ||

| General | Credit Status | Zero Credit Card Balance

Late payment Use of payday loans Credit applications Denial of credit

|

| Summary | Net Worth | Total Financial Assets

Total Non-Financial Assets Total Assets Total Debts Net Worth |

| Financial Health and Risk | Debt-To-Income Ratio

Home Equity |

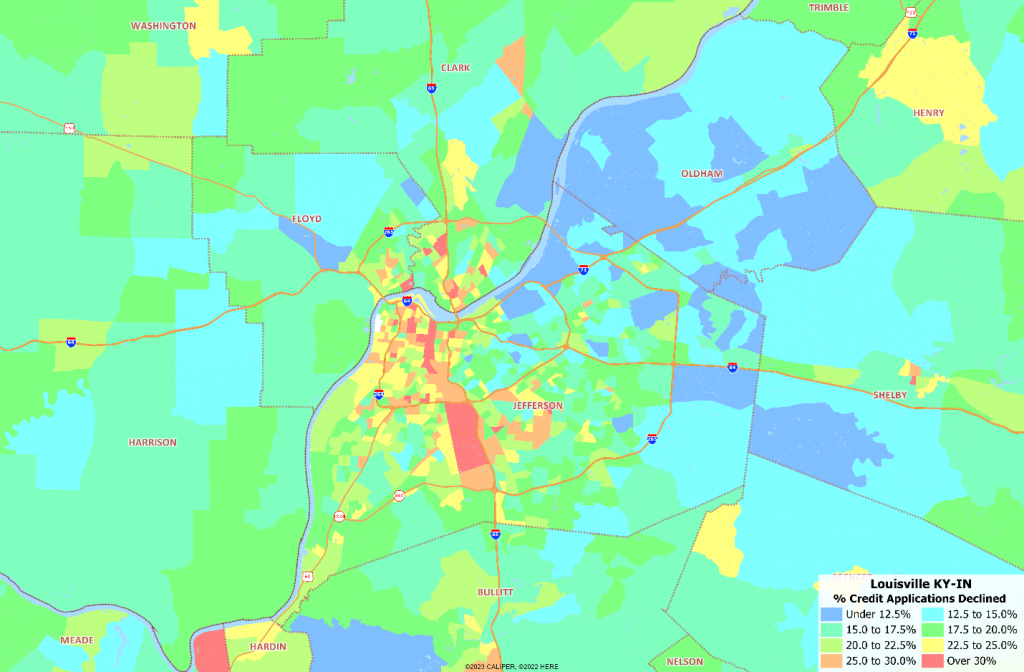

The map below shows the percentage of applications for credit which are denied, by block group, for Louisville KY-IN:

This new database will be available with the 2024A release in early May, 2024.

Recent Comments